It’s no surprise that the US Commercial Real Estate market is a favorite among foreign investors. The US is a place where people can place their money with certainty and have a feeling of safety. We are seeing more stability here than in other areas across the globe. In 2015, Marcus & Millichap reported in its third quarter foreign investment report that foreign investments in the US was 17 percent of the market’s total dollar volume. That was a total of more than $90 billion just last year.

We have seen several purchases this year by foreign investors, especially investors from China. Some recent deals include the $1.65 billion Manhattan office tower on Sixth Avenue that China Life Insurance Group Company recently purchased; Manhattan’s Walforf-Astoria Hotel was just sold for $2 billion to Anbang Insurance Group Co.; and Greenland Group (Chinese real estate giant) is working on a $1 billion downtown project in Los Angeles called “Metropolis”.

Sectors and Markets

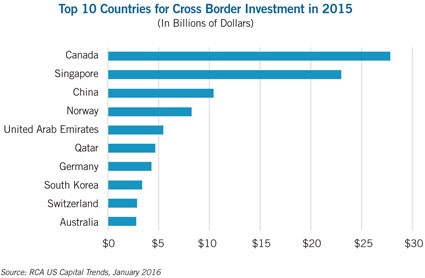

The foreign sector is not limited to Chinese investors. The top source of capital coming to the US has actually been from Canada for many years. Canadian investors have been active in the US market for a very long time. The top three foreign investors in 2015 were Canada, Singapore, and China. Red Capital Analytics reports their findings below.

Usually see foreign investors piling capital into our nation’s major metro areas such as Boston, New York, Washington, Los Angeles, Chicago, and San Francisco. Now we are seeing the market switch and smaller cities are seeing more action such as a market known as “Tertiary West”. This market includes smaller cities such as: Reno, Nevada; Yuma, Arizona; and Bakersfield, California.

Will This Trend Continue?

According to Rhodium economist Thilo Hanemann, California’s prime markets, San Francisco and Los Angeles remain “well-positioned” to continue to get their share of the money flowing in from Chinese investments, an amount that could top $200 billion by 2020.

Interest rates continue to be low and there is a notable amount of capital available to invest in the US market according to Red Capital Analytics. We have seen an increase in joint ventures, where foreign investors buy portions of existing assets, allowing US investors to garner gains while continuing to hold an interest in the assets.